does wyoming charge sales tax

While Wyomings sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The state of Wyoming has a 4 sales tax that applies to each purchase made except for some services groceries and prescription drugs in all 23 counties.

State wide sales tax is 4.

. But how you will file this sales tax is the question in your mind. You must collect sales tax at the tax rate where the item is being delivered. This page discusses various sales tax exemptions in Wyoming.

Groceries and prescription drugs are exempt from the Wyoming sales tax. Wyomings state-wide sales tax rate is 4 at the time of this articles writing but local taxes bring the effective rate up to 6 depending on the area. The state of Wyoming has a 4 sales tax that applies to each purchase made except for some services groceries and prescription Trending.

Currently local municipalities do not add extra taxes to liquor and beer. Wyoming charges a 4. Wyoming State Sales Tax information registration support.

We advise you to check out the Wyoming. Wyoming is a destination-based sales tax state. What states have tax free food.

The state of Wyoming has a 4 sales tax that applies to each purchase made except for some services groceries and prescription drugs in all 23 counties. In addition Local and optional taxes can be assessed if approved by a vote of the citizens. This page describes the taxability of.

Wyoming levies an excise tax on alcohol. Businesses must collect the special excise taxes on top of the sales tax rate of. The state of Wyoming has a 4 sales tax that applies to each purchase made except for some services groceries and prescription drugs in all 23 counties.

Wyoming charges a 4 sales tax to its people. So if you live in Wyoming collecting sales tax is not very easy. Ad New State Sales Tax Registration.

Ad Lookup WY Sales Tax Rates By Zip. The state of Wyoming has a 4 sales tax that applies to each purchase made except for some services groceries and prescription drugs in all 23 counties. The state of Wyoming has a 4 sales tax that applies to each purchase made except for some services groceries and prescription drugs in all 23 counties.

The state of Wyoming has a 4 sales tax that applies to each purchase made except for some services groceries and prescription drugs in all 23 counties. The state of Wyoming has a 4 sales tax that applies to each purchase made except for some services groceries and prescription drugs in all 23 counties. You must read the following.

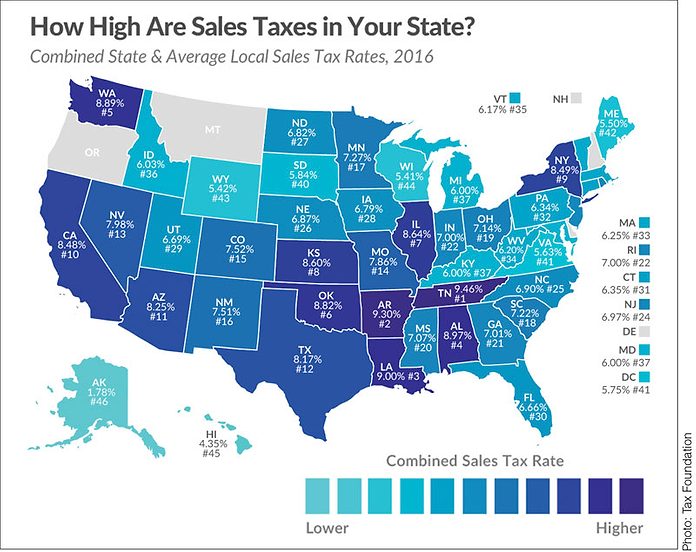

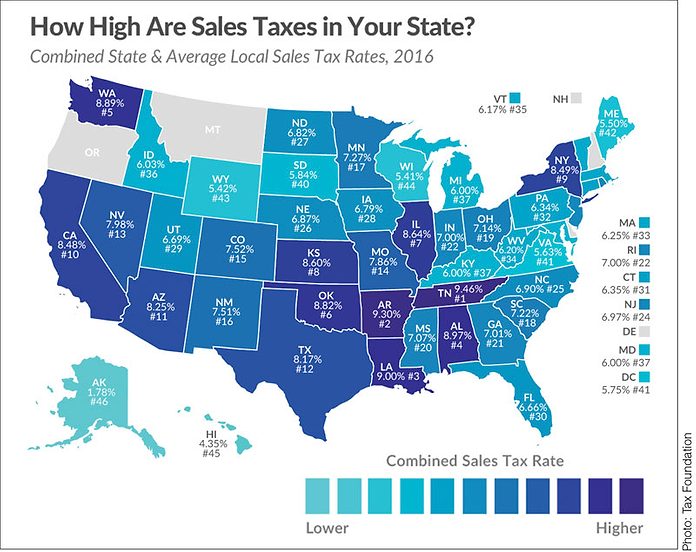

If you register for your sales tax permit the state will. Wyoming has a statewide sales tax rate of 4 which has been in place since 1935. The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547.

This page describes the taxability of. Free Unlimited Searches Try Now. Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from.

See the publications section for more information. The state of Wyoming does not usually collect sales taxes on the vast majority of services performed. While the Wyoming sales tax of 4 applies to most transactions there are certain items that may be exempt from taxation.

An example of taxed services would be one which sells repairs alters or improves. While Wyomings sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Sales Tax By State Is Saas Taxable Taxjar

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

What Is Sales Tax A Complete Guide Taxjar

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How To File And Pay Sales Tax In Wyoming Taxvalet

How Do State And Local Sales Taxes Work Tax Policy Center

How To File And Pay Sales Tax In Wyoming Taxvalet

Wyoming Sales Tax Small Business Guide Truic

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Fact 900 November 23 2015 States Tax Gasoline At Varying Rates Department Of Energy

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

Avoid Penalties By Staying Aware Of Sales Tax Laws

Jobs Research And Development And Investment Tax Credits As Of July 1 2012 Tax Foundation Map State Tax Business Tax

Infographic Where U S Student Debt Is Highest Lowest Student Debt Infographic Student Debt Educational Infographic